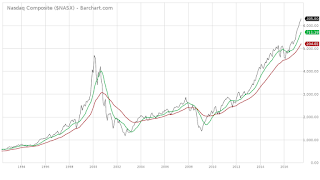

Markets are performing a little better so far in 2023. The stage analysis indicators are moving into positive territory with the exception of the NASDAQ which has been affected by weakness in tech and the ups and downs of Tesla via Mr. Musk.

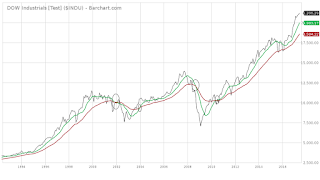

Let's take a look at some charts. The Dow may be entering into Stage 1 as shown below with the upturn of the 30 week moving average.

For the first time in over a year, Indicator #5 is positive. For this indicator, we look to see if the NYSE Advance-Decline (A-D)

is above or below its 200 day moving average. The divergence between the

advances and declines is plotted on a chart, and the 200 day moving

average is also plotted.

At this point I am watching and gently buying shares of some stock that I think may be in for an upward climb.