Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Sunday, March 27, 2016

Weekly Market Update: Caution

The positive gains of the last couple of weeks appear to be at risk for moving back into negative territory. If you bought during the last couple of weeks, remember the Sell Rules and make sure you have protective stops in place.

Saturday, March 19, 2016

Weekly Market Update: Sunny

Once the NASDAQ moves above its 30 week moving average, we'll have 8 out 9 indicators in the green. The Global DOW pushed above its 30 week moving average for the first time since July 2015. I don't foresee the Dow Dividend Ratio moving into the green anytime soon.

At this point, I am moving cautiously back into the market. We are not firmly in an uptrend but signs are improving. I will feel better about it when the 30 week moving averages begin an upward slope. Most have flattened which is encouraging because it means they are no longer moving downward.

At this point, I am moving cautiously back into the market. We are not firmly in an uptrend but signs are improving. I will feel better about it when the 30 week moving averages begin an upward slope. Most have flattened which is encouraging because it means they are no longer moving downward.

| ||||||||||||||||||||

| To see the some of associated charts, click on the following links: | ||||||||||||||||||||

Wednesday, March 16, 2016

Selling Rules

Stan Weinstein outlines the following steps for selling stocks in his book Secrets For Profiting in Bull and Bear Markets.

The Don't List

- Don't Sell for tax reasons.

- Don't base your selling decision on how much the stock is yielding.

- Don't hold onto a stock because the price/earnings (P/E) ratio is low.

- Don't sell a stock simply because the P/E is too high.

- Don't average down in a negative situation. Professionals average up, not down.

- Don't refuse to sell because the overall market trend is bullish.

- Don't wait for the next rally to sell.

- Don't hold onto a stock simply because it is of high quality.

The Do List

Use Protective Stop-Loss orders

Increased volatility in the market makes this tactic very important. Swings occur very quickly and a stop-loss can protect your position if a stock moves down quickly. A stop-loss sets the price at which you want to place a sell order. For example, if a stock is selling at $30 and you set your stop-loss at $25, the stock won't sell unless the prices moves to $25 or lower. I find stop-loss orders bring me peace

of mind because I can go about my day without worrying about whether I

am protected. There is no need to watch the market all day.

Setting the Stop-Loss Order

Set the initial Stop-Loss when entering position

When buying a stock, set your initial stop-loss order amount. You should always know your exit point when entering into a position. Use the prior support level to set your first stop. Set the stop just above the prior support level.

Subsequent Stop-Loss Settings

If your stock purchase has turned into a winner, set subsequent stop-loss orders. In both cases, you should move your stop-loss up as the stock advances and sets new floors.

- Investors (long term) - set just below the 30 week moving average.

- It is okay if the stock slightly breaks the 30 week moving average as long the moving average is sloping up.

- Note there can be some stiff pull-backs if you are in for the long haul.

- Get out of the stock if the 30 week moving average starts to slope down.

- Traders (short term) - set just below the prior bottom which might be above the 30 week moving average.

- Set the first stop closest to the prior floor. If there isn't one, set it to 4%-6% below.

- Do not pay attention to corrections less than 7%.

- Get out if the 30 week moving average starts to slope down.

- Take profits on the way up if your stock moves up very quickly and becomes overextended, i.e. far above the 30 week moving average.

Saturday, March 12, 2016

Weekly Market Update: Market Improvements

The market is showing some positive signs of improvement this week. Use Caution, we are not out of the woods yet. It might be a good time for some short term trades.

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P are above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart. This is a positive signal.

5. NYSE 200 day Moving Average.The NYSE is above its 200 day moving average this week. Another positive signal.

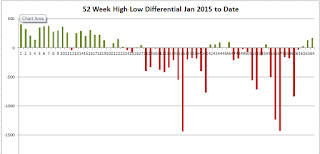

6. NYSE 52 Weeks Highs vs. Lows. Third week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.91

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P are above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart. This is a positive signal.

5. NYSE 200 day Moving Average.The NYSE is above its 200 day moving average this week. Another positive signal.

6. NYSE 52 Weeks Highs vs. Lows. Third week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.91

Sunday, March 6, 2016

Weekly Market Update: Partly Sunny

The market is showing some positive signs of improvement this week. Go lightly as this may not stick.

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P broke above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE broke above its 200 day moving average this week. This first time in months.

6. NYSE 52 Weeks Highs vs. Lows. Second week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.61

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P broke above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE broke above its 200 day moving average this week. This first time in months.

6. NYSE 52 Weeks Highs vs. Lows. Second week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.61

Wednesday, March 2, 2016

Buying Rules

At some point the market will move into Bull Territory again and we will be looking for stocks or ETFs to trade. A new Buying Rules tab has been added to the site. Click here to see the rules or read below.

Stan Weinstein outlines the following steps for buying stocks in his book Secrets For Profiting in Bull and Bear Markets .

.

Never, ever buy a stock in Stage 4 no matter how exciting the story! Do homework and scouting on weekends.

Look at the market sectors and pick the best groups to zero in on.

Make an initial list of stocks in those sectors.

Cull out those few stocks with the most potentially profitable formation within those favorable groups in step #2 based on:

Before entering your buy order, make sure you know where your protective sell-stop will be set.

Put in your buy-stop orders for half of your position.

If volume is favorable on the breakout and contracts on the decline, buy the other half on a pullback toward the initial breakout.

Stan Weinstein outlines the following steps for buying stocks in his book Secrets For Profiting in Bull and Bear Markets

Never, ever buy a stock in Stage 4 no matter how exciting the story! Do homework and scouting on weekends.

Steps

Step 1 - Identify the sectors or groups with the best performance

Check the market indicators for overall direction. This blog posts the direction every week.Look at the market sectors and pick the best groups to zero in on.

Make an initial list of stocks in those sectors.

Cull out those few stocks with the most potentially profitable formation within those favorable groups in step #2 based on:

- Bullish patterns

- Within the Trading Range

- Relative Strength - should be above market

- Volume

- Stock is in Stage 2. Never buy a stock in stage 3 or 4!

Step 2 - Buy setups

Use your checklist! It should contain some of the rules outlined below.Before entering your buy order, make sure you know where your protective sell-stop will be set.

Put in your buy-stop orders for half of your position.

If volume is favorable on the breakout and contracts on the decline, buy the other half on a pullback toward the initial breakout.

The Don't Buy List

- Don't buy in a bear market.

- Don't buy a stock in a negative sector.

- Don't buy a stock below its 30 week moving average.

- Don't buy a stock with a declining 30 week moving average.

- Don't buy too late in an advance above the entry point. There will be other stocks.

- Don't buy on poor volume.

- Don't buy on poor relative strength.

- Don't buy if heavy overhead resistance.

- Don't guess a bottom.

- Don't buy a stock in stages 3 or 4.

- Don't feel you have to be invested all the time. It is okay to be in cash.

Subscribe to:

Posts (Atom)