This week the market had a few days with big swings up and then back down again. A lot of action.

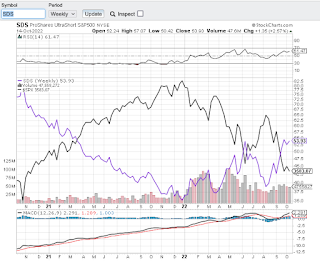

One comparison I like to do is to compare the short SPY ETF to the S&P index. As we can see below the last cross over occurred in September. The SDS is above the SPY signalling we have more short action than buying action. Not a good sign.

October can be a loss harvest month with the mutual funds and it's possible that is contributing to some of the downside. All indicators remain in the red.