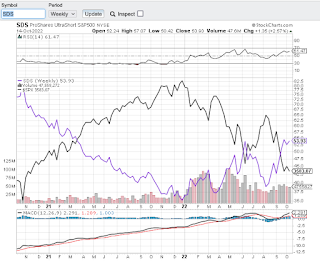

This week the DOW moved beneath it's 30 week moving average and the SPY and NASDAQ's 30 meek moving average reversed and is pointing down. Any hopes of moving into Stage 1 is squashed as we are again in Stage 4 decline. See previous post for Stage Analysis.

In addition Indicator 5: NYSE Advance-Decline 200 day moving average is touching the moving average line as shown below in this StockChart's graph.

The only index still positive is the Global DOW.

Some are pointing to the Silicon Valley Bank (SVB) Collapse as the main reason for last week's market downturn. Investors are watching to see if a bailout will take care of investors with deposits above the FDIC’s $250,000 cap.

Never a dull moment.