2023 was a great year for the stock market. We finally saw some improvements after the long sideways performance of 2022.

- S&P - up 26%

- Dow - up 13%

- NASDAG - up 53%

We appear to be in Stage 2 going into 2024 which is a positive sign. A review of Stage 2. This is a time to invest.

- Stage 2 - Advancing Phase

- 30 week moving average slopes up.

- Close is above the 30 week Moving Average, with higher lows

- Fundamentals improve

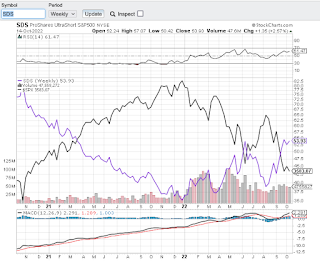

Slickcharts has some fantastic charts. Here is one showing returns year over year for the S&P.