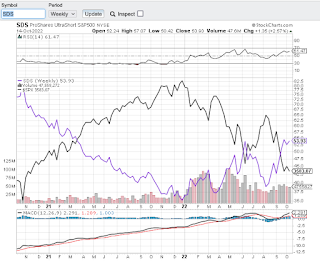

Stocks are starting to look a little bit better with some of the indicators getting poised for positivity. We're not there yet but at least there is some improvement. It's been a about a year for this market's downturn.

Green represents a glimmer of hope but doesn't make the indicator positive until the moving average line slopes up.

Indicators:

- DOW - 30 Week Moving Average Line flat, close above the line

- S&P - 30 Week Moving Average Line flat, close above the line

- NASDAQ - Below the line

- Global DOW - 30 Week Moving Average Line flat, close above the line

- NYSE AD and DOW Convergence - Both down

- NYSE AD 200 Day Moving Average

- NYSE 52 Week Highs and Lows

I am hopeful 2023 will be the year we turn the tide, until then let's watch the tape!