Market indicators are mixed. The recent upturn appears to be on shaky ground with Nassim Taleb calling for hedging a long tail.

With that in mind, let's see where gold is from a stage perspective using the GLD ETF via stockcharts.

The moving average is sloping up, the close is above the 30 week moving average and fundamentals for gold are improving if you consider that it is widely viewed as a hedge for the market. The chart below shows the peak of gold during the 2009 market downturn was around $180. Current prices is $162. If we consider 180 to be the ceiling then we may have room for higher prices.

How about looking at the tech sector? The NasDaq continues to be in a stage 2 accumulation phase.

Overall, the market is choppy however, and that indicates we are still in phase 4 overall. The DOW and S&P are not in stage 2 but are still in stage 4.

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Sunday, June 28, 2020

Sunday, June 7, 2020

Stock Market Update: Week Ending June 5, 2020

Big rebound in markets this week with an upbeat jobs report.

From a stage analysis perspective, we have the following:

Many areas in the US are re-opening in phases and fingers crossed, we can re-open without a resurgence in cases. We all need to get out of the house!!

From a stage analysis perspective, we have the following:

- DOW & S&P : Stage 4. The 30 week moving average is still sloping down or is flat.

- NASDAQ: Stage 1: Closing price above the 30 week moving average and the moving average is sloping upward

Many areas in the US are re-opening in phases and fingers crossed, we can re-open without a resurgence in cases. We all need to get out of the house!!

Sunday, May 31, 2020

Stock Market Update: End of May 2020

Well we're at the end of May and it's been a ride! Markets rebounded and there is hope, at least here in New York, that we can start to re-open. NY has a 4 phase approach. Note, all have extensive rules, see the official page for more information.

- Phase 1:

- Construction

- Agriculture, Forestry, Fishing and Hunting

- Retail - (Limited to curbside or in-store pickup or drop off)

- Manufacturing

- Wholesale Trade

- Phase 2:

- Offices

- Real Estate

- Essential and Phase 2 in-store retail

- Vehicle sales, lease, rentals

- Retail rental, repair and cleaning

- Commercial building management

- Hair salons and barbershops (Yay)

- NOT OPEN:

- Malls

- Dine-in and on-premise restaurant or bar service, excluding take-out or delivery for off-premise consumption;

- Large gathering/event venues

- Gyms, fitness centers, and exercise classes,

- Video lottery and casino gaming facilities;

- Movie theaters, except drive-ins; and

- Places of public amusement

- Phase 3:

- The guidelines below apply to non-essential businesses in regions that are permitted to reopen, essential businesses throughout the state that were previously permitted to remain open, and commercial and recreational activities that have been permitted to operate statewide with restrictions

- NOT OPEN: Restaurants and dine-in

- Phase 4:

- NOT OPEN:

- Arts / Entertainment / Recreation

- Education

- NOT OPEN:

Monday, May 25, 2020

Stock Market Update: Week Ending May 22, 2020

Markets are mixed. There are signs of hope as states start to reopen. The Wall Street Journal has a nice map.

Many are limiting gatherings to 10 people or less. It would be nice to see a little more flexibility in some of the restrictions. If a wine store can be an 'essential' business and allow foot traffic, then you would think some additional retail stores could also be open with managed foot traffic. We want our small businesses to stay open and functioning, they are the backbone of our towns.

The NASDAG continues to be in a Stage 1 uptrend, while the S&P and DOW remain in Stage 4 decline. GLD appears to be strongly in Phase 2.

Sunday, May 17, 2020

Stock Market Update - Week Ending May 15, 2020

From a stage analysis perspective, the market continues to be in Stage 4.

The NASDAQ continues to be in a stage 1, but the other indexes are in stage 4.

The CDC map for the week

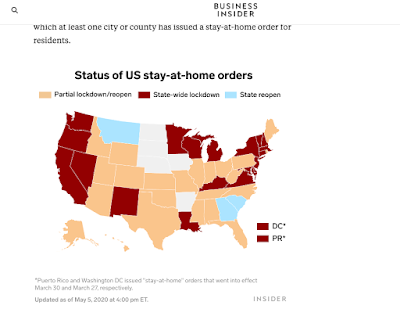

Stay at home orders map from Business Insider.

The NASDAQ continues to be in a stage 1, but the other indexes are in stage 4.

The CDC map for the week

Stay at home orders map from Business Insider.

Sunday, May 10, 2020

Stock Market Update: Week Ending May 8, 2020

The stock market is starting to look like it is on a recovery which is confusing for some considering the job market. The stock market is a future looking beast, and it may be telling us that it sees a recovery next year.

Will we have a roaring 20's similar to the recovery after the Spanish Flu of 1918 - 1920?

There are differing opinions, here are three:

- No lessons to be learned. The DOW rallied in the Spanish Flu and WW1 was underway. (ETF Stream)

- A balanced view. Decline then recovery (Trader's Magazine)

- Lockdowns and other measures were common, masks were required. Market's bounced back (Motley Fool)

States are beginning to work on re-opening. (Business Insider)

A look at this week's CDC COVID map.

Cheers. Pickles.

Sunday, May 3, 2020

Stock Market Update: End of April 2020

The market is on a wild ride, swinging from positivity to negativity with wide ranges. The DOW and S&P are in stage 4, the NASDAQ is in a possible stage 1.

COVID-19 continues to dominate the world. States in the US are beginning to plan re-opening business. Here is this week's COVID map. Note the new color purple used to designate cases above 28,764.

Caution with stocks is recommended as we still in a stage 4 and the candlesticks in the charts above show wild swings in stock price movements.

Subscribe to:

Posts (Atom)