Markets continue their steady upside and just might be ready for a pull back, but then again maybe not. It feels like we are in the wait and see mode. The Dow missed hitting 20,000 in case you are watching and wondering.

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Monday, December 26, 2016

Saturday, December 10, 2016

Weekly Stock Market Update: Stocks are in the Ozone

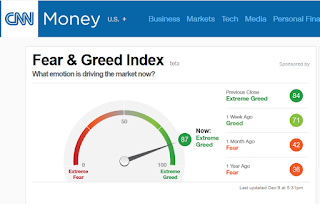

The market is up! All indicators are green. Ichan says the market rally "has gone too far" and the CNN Fear and Greed Index is at Extreme Greed.

Interesting, the Weinstein Stage analysis of the S&P shows a possible Stage 2 accumulation. See this StockCharts graph of the $SPX.

Interesting, the Weinstein Stage analysis of the S&P shows a possible Stage 2 accumulation. See this StockCharts graph of the $SPX.

Monday, December 5, 2016

Weekly Market Update: Mixed Signals

Two of the indicators related to the Dow and NYSE Advance-Decline went red for the week. The moving averages of the major indexes also ended down but did not break their moving average lines. Most likely things will be unsettled and we might get a bit of a bounce from all the year end mutual fund settlements.

Have you seen the movie "The Big Short"? It's a great movie about the last crash and drives home the importance of doing homework, real homework, bubbles and greed. Do we have any bubbles now? I think the last one was big pharma.

Be cautious.

Have you seen the movie "The Big Short"? It's a great movie about the last crash and drives home the importance of doing homework, real homework, bubbles and greed. Do we have any bubbles now? I think the last one was big pharma.

Be cautious.

Sunday, November 27, 2016

Weekly Stock Market Update: Continued Uptrend

This was a very short week that ended in positive territory. A number of market watchers are finding the new highs nerve wracking. Watch the indicators for signs, so far they are on the way up.

Monday, November 21, 2016

Weekly Market Update: Continued Uptrend

All the indicators remain in the green this week even though we started to see some pressure placed on stocks towards the end of last week. This week will be shortened due to the Thanksgiving Holiday. I am scouting for short term trades because I don't think we know yet what the new president will do for the stock market. Cheers.

Monday, November 14, 2016

Weekly Stock Market Update: Rebound

The elections are finally over! Stocks reacted to the election of "The Donald" wildly, with a plunge the night of the election and then a rebound the following day. All he had to do was talk like a sensible person. The question is, will that be how he acts as president? Or, will he act like he did during the election? My hunch, is that we will have both. This could provide some volatility and maybe some opportunities in the next few years. Nobody really knows, that is why having a system is important. This is a good time to re-read the rules! Keep a level head and carry on!

Sunday, November 6, 2016

Weekly Stock Market Update: Indicators Turn Negative

With the drama of the upcoming election on Tuesday, the market took a downturn last week. All my indicators, with the exception of the NYSE AD vs. 200 Day Moving Average went into the Red. And, with that, the last one is on its way to going red.

Let's see what unfolds on Tuesday!

Let's see what unfolds on Tuesday!

Subscribe to:

Posts (Atom)