The market is showing some positive signs of improvement this week. Use Caution, we are not out of the woods yet. It might be a good time for some short term trades.

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P are above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart. This is a positive signal.

5. NYSE 200 day Moving Average.The NYSE is above its 200 day moving average this week. Another positive signal.

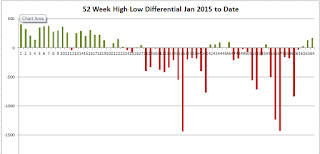

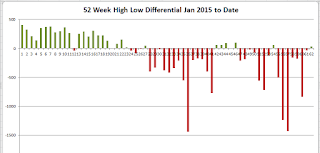

6. NYSE 52 Weeks Highs vs. Lows. Third week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets.

The Global Dow is making headway on the 30 week moving average. One

word of caution however is that the 30 week moving average is still on a

downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.91

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Saturday, March 12, 2016

Sunday, March 6, 2016

Weekly Market Update: Partly Sunny

The market is showing some positive signs of improvement this week. Go lightly as this may not stick.

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P broke above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE broke above its 200 day moving average this week. This first time in months.

6. NYSE 52 Weeks Highs vs. Lows. Second week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.61

1 - 3. Major indexes vs. their 30 week moving averages. The Dow and S&P broke above their 30 week moving average this week. The NasDaq did not cross over but is making positive headway.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE broke above its 200 day moving average this week. This first time in months.

6. NYSE 52 Weeks Highs vs. Lows. Second week of good numbers.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is making headway on the 30 week moving average. One word of caution however is that the 30 week moving average is still on a downward slope.

9. Cost of a Dividend on the DOW. Still costly at 38.61

Wednesday, March 2, 2016

Buying Rules

At some point the market will move into Bull Territory again and we will be looking for stocks or ETFs to trade. A new Buying Rules tab has been added to the site. Click here to see the rules or read below.

Stan Weinstein outlines the following steps for buying stocks in his book Secrets For Profiting in Bull and Bear Markets .

.

Never, ever buy a stock in Stage 4 no matter how exciting the story! Do homework and scouting on weekends.

Look at the market sectors and pick the best groups to zero in on.

Make an initial list of stocks in those sectors.

Cull out those few stocks with the most potentially profitable formation within those favorable groups in step #2 based on:

Before entering your buy order, make sure you know where your protective sell-stop will be set.

Put in your buy-stop orders for half of your position.

If volume is favorable on the breakout and contracts on the decline, buy the other half on a pullback toward the initial breakout.

Stan Weinstein outlines the following steps for buying stocks in his book Secrets For Profiting in Bull and Bear Markets

Never, ever buy a stock in Stage 4 no matter how exciting the story! Do homework and scouting on weekends.

Steps

Step 1 - Identify the sectors or groups with the best performance

Check the market indicators for overall direction. This blog posts the direction every week.Look at the market sectors and pick the best groups to zero in on.

Make an initial list of stocks in those sectors.

Cull out those few stocks with the most potentially profitable formation within those favorable groups in step #2 based on:

- Bullish patterns

- Within the Trading Range

- Relative Strength - should be above market

- Volume

- Stock is in Stage 2. Never buy a stock in stage 3 or 4!

Step 2 - Buy setups

Use your checklist! It should contain some of the rules outlined below.Before entering your buy order, make sure you know where your protective sell-stop will be set.

Put in your buy-stop orders for half of your position.

If volume is favorable on the breakout and contracts on the decline, buy the other half on a pullback toward the initial breakout.

The Don't Buy List

- Don't buy in a bear market.

- Don't buy a stock in a negative sector.

- Don't buy a stock below its 30 week moving average.

- Don't buy a stock with a declining 30 week moving average.

- Don't buy too late in an advance above the entry point. There will be other stocks.

- Don't buy on poor volume.

- Don't buy on poor relative strength.

- Don't buy if heavy overhead resistance.

- Don't guess a bottom.

- Don't buy a stock in stages 3 or 4.

- Don't feel you have to be invested all the time. It is okay to be in cash.

Saturday, February 27, 2016

Weekly Market Update: Mix of Sun and Clouds

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average. We are starting to see some minor improvements however, with the close line moving up over the last two weeks.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still below its 200 day moving average. Another indicator gaining momentum on the moving average.

6. NYSE 52 Weeks Highs vs. Lows. First time in the green in months!

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is still below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.88

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still below its 200 day moving average. Another indicator gaining momentum on the moving average.

6. NYSE 52 Weeks Highs vs. Lows. First time in the green in months!

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is still below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.88

Saturday, February 20, 2016

Weekly Market Update: Bear Market Continues

My indicators continue show a Bear Market.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Small improvement from last week.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.31

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved up this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Small improvement from last week.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both up.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.31

Wednesday, February 17, 2016

Patience

One piece of advise is consistent among my 3 favorite books (Rule #1, Stan Weinstein's Secrets for Winning in Bull and Bear Markets, and The Little Book of Market Wizards) and the advice is to have patience.

Chief among the recommendations is to review the market on nights and weekends. Do not, I repeat DO NOT, watch the market all day. It will mess with your head!

Here are some of the nuggets I have found to be most helpful:

Chief among the recommendations is to review the market on nights and weekends. Do not, I repeat DO NOT, watch the market all day. It will mess with your head!

Here are some of the nuggets I have found to be most helpful:

- Review stocks when the market is closed (nights or weekends).

- Don't watch quotes all day long because it can lead to over-trading.

- Resist the temptation to trade all the time.

- Don't trade on hunches. Have a system. See my prior post on using a checklist.

- Don't announce ideas to your friends because you will the become too attached to those ideas, lest you look like a fool.

- Doing nothing is harder than it sounds.

- Don't sell too early, stay with winners (let your winners run) and sell the losers.

- The trades not taken matter as they preserve capital.

Subscribe to:

Comments (Atom)