My indicators continue show a Bear Market.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved down this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Any improvement from last week is gone.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both down.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 36.10

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Saturday, February 13, 2016

Wednesday, February 10, 2016

Technical Indicator: MACD

MACD - Technical Tool

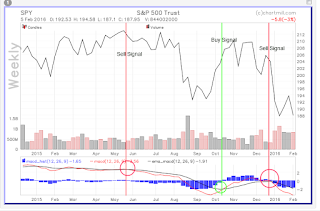

One of the technical indicators covered in Phil Town's Rule #1 book is the MACD. MACD stands for Moving Average Convergence Divergence and is a tool to gauge momentum pressure. It uses 3 EMAs (exponential moving average); slow, fast and a trigger for crossing.Investopedia has a nice explanation here:

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the "signal line", is then plotted on top of the MACD, functioning as a trigger for buy and sell signals.

Read more: Moving Average Convergence Divergence (MACD) Definition | Investopedia http://www.investopedia.com/terms/m/macd.asp#ixzz3zOt9BgfC

How to use the MACD

I use the MACD for buy and sell signals, along with my other tools. A buy signal is when the black line crosses above the red line, and likewise, a sell signal is when the red crosses the black line.Let's look at the MACD on the weekly SPY (S&P ETF) using Chartmill. A sell signal was flashed in the May/June 2015 time frame, well before the August sell off. We had a buy signal flash in October of 2015 with a subsequent sell signal returning on January 2016.

As of this writing, the MACD is suggesting we stay out of the SPY. As the SPY can be viewed as a broad market indicator, it can also provide information on the market as a whole.

Saturday, February 6, 2016

Weekly Market Update: Bear Market Continues

My indicators continue show a Bear Market.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved down this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Some improvement, but still more new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. The Dow moved down and the NYSE HILO moved up but not enough for me to consider it a positive sign as the NYSE is still in negative territory.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 36.90

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved down this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Some improvement, but still more new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. The Dow moved down and the NYSE HILO moved up but not enough for me to consider it a positive sign as the NYSE is still in negative territory.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 36.90

Saturday, January 30, 2016

Weekly Stock Market Update: Overcast

My indicators show a Bear Market.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved up a nicely this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Some improvement, but still more new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both the and the NYSE HILO moved up.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.45

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes have downward sloping 30 week moving averages and their close lines are still below the moving average.

4. Convergence of NYSE AD and DOW. Both moved up a nicely this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. Some improvement, but still more new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. Both the and the NYSE HILO moved up.

8. International Markets. The Global Dow is still way below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 37.45

Wednesday, January 27, 2016

The Importance of having a Checklist to Guide Buying and Selling Decisions

While in a bear market, there will be days when a market rebound appears. The news will be all over it and might even declare the end of a bear market. That’s why it is important to look at data yourself and develop your own opinion on where the market is. The weekly indicators are used for the purpose of determining the market trend and help me keep a steady mind. Paying attention to stock news sites can be a wild ride.

I learned the hard way to develop a checklist for my trades. Following recommendations made by others always seems to get me into hot water. I think it’s because I don’t have the volition to stick with a stock I haven't researched myself. I need to believe in my decisions.

Here is what I have in my current checklist. I find it helps me take emotions out of the buying and selling a stock. During down markets like this, I will often review past trades to see if my checklist should be modified or updated.

Learning from past mistakes is very helpful!

Saturday, January 23, 2016

Weekly Broad Market Indicator Update: Stormy Weather

This week ended with two days of a positive closes on the major indices, however, when we look at it from a broad view, we are clearly not out of hot water yet. My indicators show a Bear Market.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes blew down past their 30 week moving averages.

4. Convergence of NYSE AD and DOW. Both moved up a little this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. This is a very telling chart. More new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. The Dow moved up, while the NYSE HILO moved down. Not a positive signal.

8. International Markets. The global dow is well below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 36.63.

1 - 3. Major indexes vs. their 30 week moving averages. All three indexes blew down past their 30 week moving averages.

4. Convergence of NYSE AD and DOW. Both moved up a little this week. Click here to see Barron's chart.

5. NYSE 200 day Moving Average.The NYSE is still well below its 200 day moving average.

6. NYSE 52 Weeks Highs vs. Lows. This is a very telling chart. More new lows than new highs.

7. NYSE 52 Week High Low vs. Dow Convergence/Divergence. The Dow moved up, while the NYSE HILO moved down. Not a positive signal.

8. International Markets. The global dow is well below its 30 week moving average.

9. Cost of a Dividend on the DOW. Still costly at 36.63.

Tuesday, January 19, 2016

Stage Analysis - Where are we now?

Stan Weintstein's book "Secrets for Profiting in Bull and Bear Markets", relies heavily on Stage Analysis, a method of evaluating a stock and/or an index in terms of accumulation (buying or selling). Using the Stage Analysis model there are four (4) distinct stages every stock and market goes through. I believe we entered Stage 4 in August and remember, I don't buy in Stage 4 because I don't know when it will end.

Stage Analysis:

Stage Analysis:

- Stage 1 - Basing Phase (February 2012)

- 30 week moving average loses its downward slope and starts to improve

- Stage 2 - Advancing Phase (January 2013)

- 30 week moving average slopes up.

- Close is above the 30 week moving average, with higher lows

- Fundamentals improve

- Stage 3 - The Top Phase (May 2015)

- Loses momentum

- Choppy market

- 30 week moving average loses upward slope and flattens

- Stage 4 - Declining Phase (August 2015)

- Close line below Moving average

- 30 week moving average is sloping down

Subscribe to:

Comments (Atom)