Wait and see. That's my current approach. I think the president elect may have affects on the market so I am not in any individual stock. Things are too unpredictable at the moment.

Andrew Horowitz at The Disciplined Investor has been calling Mr. Trump Twitter-in-Chief due to his propensity to tweet. This week Toyota's stock felt a little bit of an impact from one of those tweets from Trump. The stock reacted with a drop of .7% on the intraday chart. The stock did recover later on in the week and this was a minor blip for Toyota, but it is interesting none the less.

It should be an interesting year!

It should be an interesting year!

Markets continue their steady upside and just might be ready for a pull back, but then again maybe not. It feels like we are in the wait and see mode. The Dow missed hitting 20,000 in case you are watching and wondering.

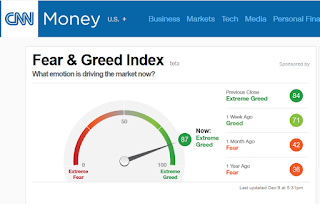

The market is up! All indicators are green. Ichan says the market rally "has gone too far" and the CNN Fear and Greed Index is at Extreme Greed.

Interesting, the Weinstein Stage analysis of the S&P shows a possible Stage 2 accumulation. See this StockCharts graph of the $SPX.

Two of the indicators related to the Dow and NYSE Advance-Decline went red for the week. The moving averages of the major indexes also ended down but did not break their moving average lines. Most likely things will be unsettled and we might get a bit of a bounce from all the year end mutual fund settlements.

Have you seen the movie "The Big Short"? It's a great movie about the last crash and drives home the importance of doing homework, real homework, bubbles and greed. Do we have any bubbles now? I think the last one was big pharma.

Be cautious.