While the indicators are fairly positive, I remain cautious. The market doesn't feel like it has conviction. Here are this week's indicators.

For Weinstein fan's Chartmill has some fantastic indicators available on its charting site. Here is a graph I put together using their tool. It shows SPY on a weekly basis with a 30 week moving average, Stage Indicators and the Weinstein RSI. We are still in Stage 1.

I am looking for the early start of Stage 2 for an entry point.

Of interest, the Dow dividend ETF is in a Stage 2 Advance indicated by the green, while the S&P ETF (SPY) and Nasdaq ETF (QQQ) are in Stage 3, indicated by the grey bars. Remember the Dow is defensive.

For information on Chartmill's Stan Weinstein indicators click here.

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Saturday, June 11, 2016

Monday, June 6, 2016

Weekly Market Update: Symbols are Up

Chartmill posted a very good article in the blog this weekend stating the market has been in a channel since April. "Since April, the Dow has been content to drift aimlessly between 17,500 and 18,000. Similarly, the S&P 500

is vacillating between roughly 2050 and 2100. Weekly volume for both

indexes declined significantly over the month of May. ...this is not a good environment for trend-followers

and you need to be wary of signals from trend-based approaches right

now."

This matches what I've seen with the symbols. They are up then down, then sideways. No real direction has emerged. This week we are up but I don't necessarily trust it.

This matches what I've seen with the symbols. They are up then down, then sideways. No real direction has emerged. This week we are up but I don't necessarily trust it.

Monday, May 30, 2016

Weekly Market Update: Improvement

This market is choppy and doesn't seem to have a sense of direction. It might stay this way until we have the elections. This week we are back in positive territory.

Saturday, May 21, 2016

Weekly Market Update: Trend Down

I am on the sidelines for now. We now have more indicators in the red and the major indexes are moving down instead of up. Take a look at these 4 year charts.

Sunday, May 15, 2016

Weekly Market Update: Appears to be heading down

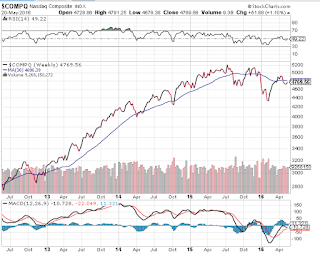

This week's indicators match last week's however, the major indexes are all heading down towards their 30 week moving average. The NASDAQ is already down and the Global Dow is now touching the line. This is not positive news and may signal an upcoming downturn.

Saturday, May 7, 2016

Weekly Market Update: Churning

We remain in a cautionary state with the same number of indicators red and green, but it is important to note that the NasDaq is under its 30 week moving average line. On the other hand, the number of new highs vs new lows continue to be positive. The direction of the market remains in meh-ville.

Saturday, April 30, 2016

Weekly Market Update: Some Indicators are Down

There was some turbulence this week as earnings season is underway. Apple took a beating, as did some other technology stocks, which brought the NasDaq below its 30 week moving average. There were some bright spots in tech, Amazon and Facebook both reported great earnings. We will see how the rest of earnings go this quarter.

Subscribe to:

Comments (Atom)