Markets continue their steady upside and just might be ready for a pull back, but then again maybe not. It feels like we are in the wait and see mode. The Dow missed hitting 20,000 in case you are watching and wondering.

Weekly stock market analysis based on Stan Weinstein's stage analysis principles. Bull and Bear Market readings, Buy and Sell checklists, Dow, S&P, Nasdaq, GDOW, NYSE, NYSE A-D, NYSE 52 week highs and lows.

Header Image

I read the tape, not the news!

Monday, December 26, 2016

Saturday, December 10, 2016

Weekly Stock Market Update: Stocks are in the Ozone

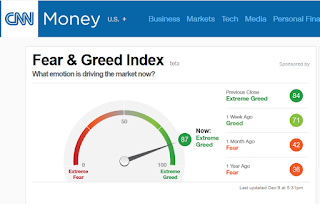

The market is up! All indicators are green. Ichan says the market rally "has gone too far" and the CNN Fear and Greed Index is at Extreme Greed.

Interesting, the Weinstein Stage analysis of the S&P shows a possible Stage 2 accumulation. See this StockCharts graph of the $SPX.

Interesting, the Weinstein Stage analysis of the S&P shows a possible Stage 2 accumulation. See this StockCharts graph of the $SPX.

Monday, December 5, 2016

Weekly Market Update: Mixed Signals

Two of the indicators related to the Dow and NYSE Advance-Decline went red for the week. The moving averages of the major indexes also ended down but did not break their moving average lines. Most likely things will be unsettled and we might get a bit of a bounce from all the year end mutual fund settlements.

Have you seen the movie "The Big Short"? It's a great movie about the last crash and drives home the importance of doing homework, real homework, bubbles and greed. Do we have any bubbles now? I think the last one was big pharma.

Be cautious.

Have you seen the movie "The Big Short"? It's a great movie about the last crash and drives home the importance of doing homework, real homework, bubbles and greed. Do we have any bubbles now? I think the last one was big pharma.

Be cautious.

Subscribe to:

Comments (Atom)